It is 2026, and the corporate world is facing a strange paradox. On the surface, CFOs have tightened the purse strings. We are in what Gartner calls the “Uncertainty Pause”, a strategic suspension of net-new spending driven by global economic jitters. Yet, somehow, money is leaking out of the building faster than ever.

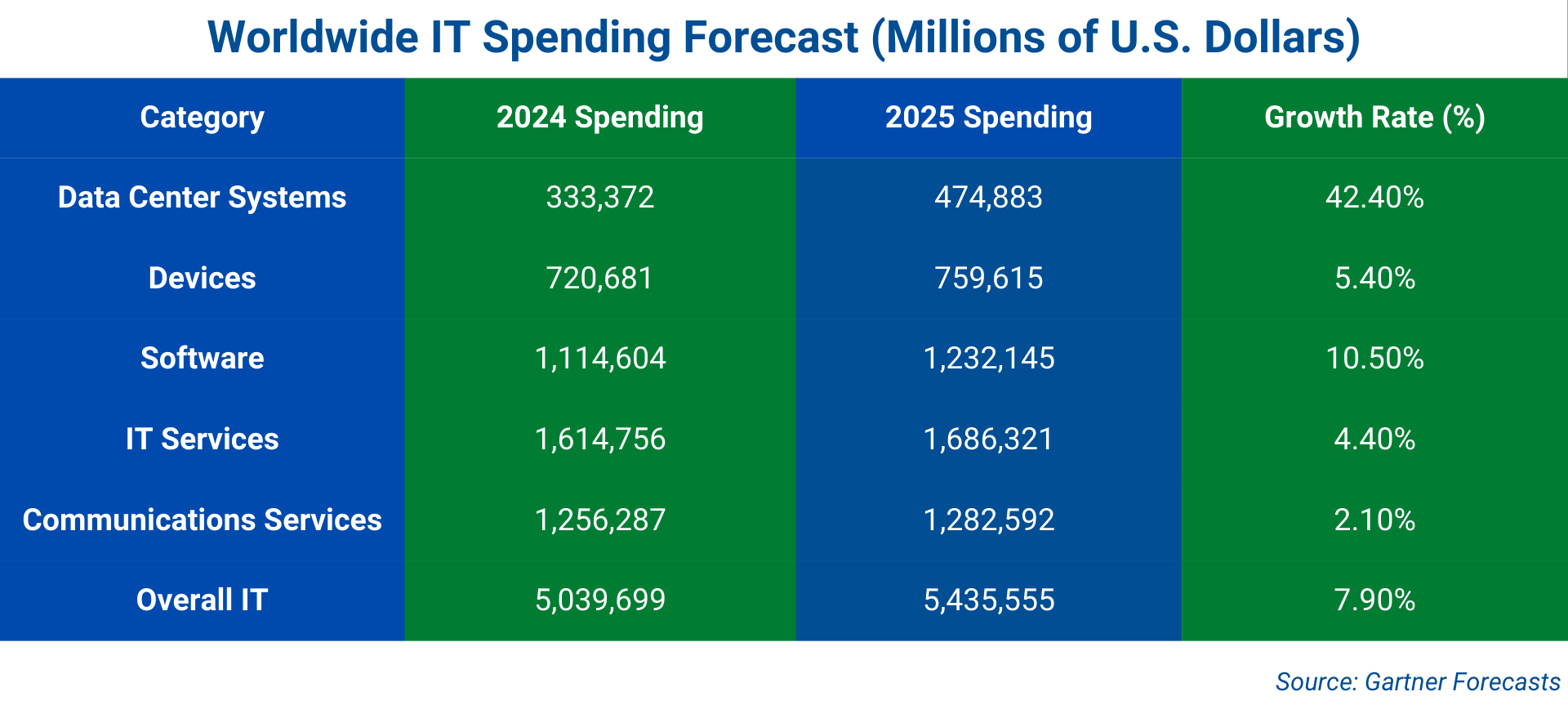

While centralized budgets are frozen, global IT spending is still surging toward $5.43 trillion. How does that math work?

The answer lies in the shadows.

Welcome to the era of “Shadow Spend.” It’s the decentralized, unmonitored expenditure that happens when your marketing manager swipes a corporate card for an unvetted AI tool, or when a sales director books a luxury suite outside of policy. It is the death by a thousand cuts that traditional spreadsheets can’t catch.

If you don’t have a comprehensive spend management strategy in place, you aren’t just losing money—you’re losing control. Here is why the “Shadow Spend” epidemic is spreading, and how modern spend management software is the only cure.

The SaaS Sprawl: The $34 Billion Waste

The biggest culprit in the shadow economy is software. In the race to adopt Artificial Intelligence, employees are bypassing IT departments entirely. They are signing up for coding co-pilots, writing assistants, and data analysis tools on their own.

Gartner estimates that “Shadow IT” now accounts for a staggering 30% to 40% of IT spending in large organizations. This isn’t just a security nightmare; it’s a financial black hole.

Without a dedicated spend management platform, you end up paying for what experts call “Zombie Subscriptions”—licenses that auto-renew for employees who left the company six months ago. Between the US and UK alone, this results in an estimated $34 billion in yearly licensing waste.

This is why cloud spend management is no longer just an IT concern; it’s a CFO imperative. You need a spend management platform that gives you visibility into every subscription, ensuring you aren’t paying retail prices for enterprise-grade tools.

The Invoice Nightmare: Why Are You Paying $13 to Spend Money?

While SaaS sprawl is the new problem, the “old” problem of manual Accounts Payable (AP) is still bleeding companies dry.

In a world of instant digital transactions, it is baffling that many finance teams still rely on paper invoices, email attachments, and manual data entry. The cost of this inertia is quantifiable and painful.

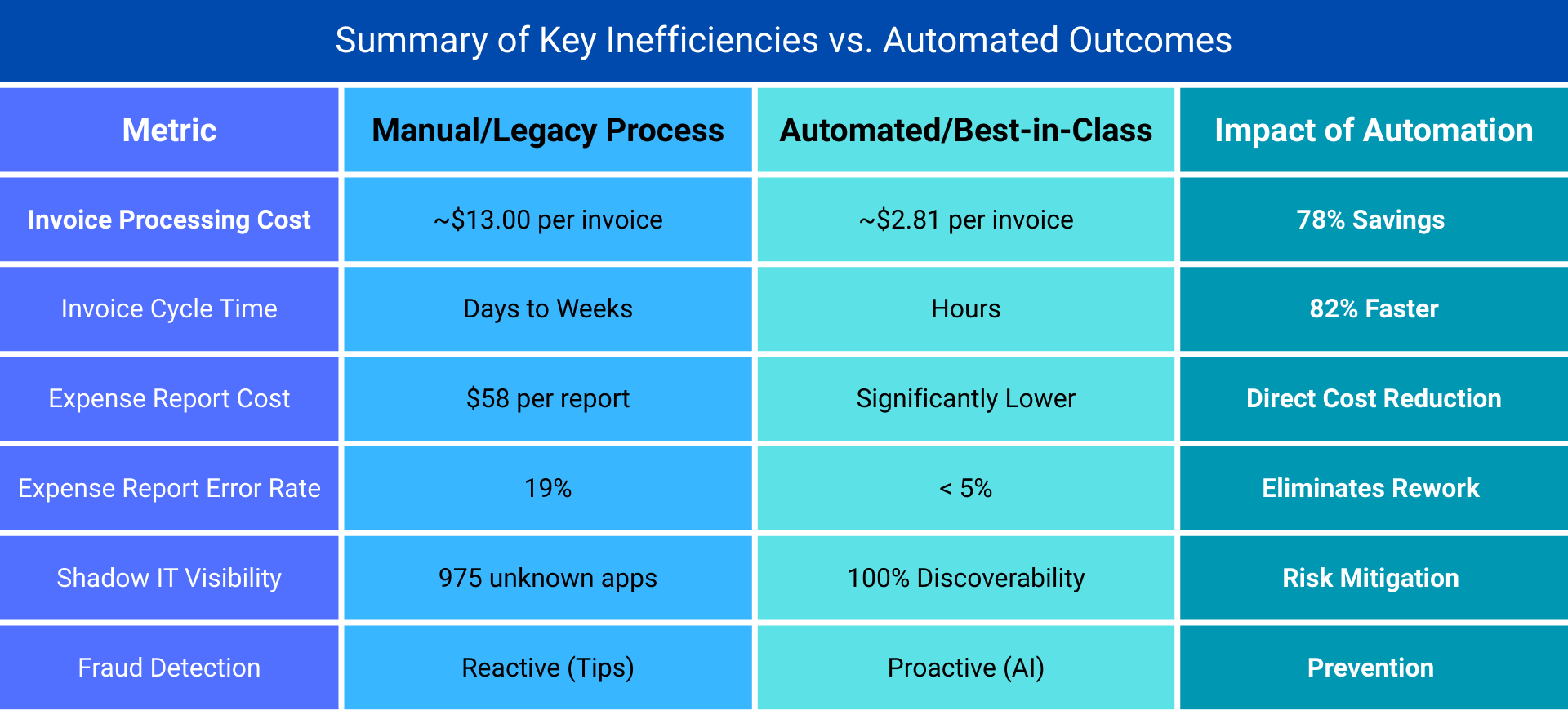

According to Ardent Partners’ 2024 ePayables research, the average cost to process a single invoice in a manual environment is approximately $13.00. That covers the labor of keying in data, chasing approvals, and fixing errors.

However, companies that implement accounts payable automation see that cost drop to around $2.81. That is a savings of nearly 78%.

But cost is only half the story. Speed is the other. AP automation reduces processing cycle times by 82%. When you use accounts payable automation software, you aren’t just saving administrative overhead; you are unlocking early-payment discounts and improving supplier relationships.

If your team is drowning in paper, it is time to look at accounts payable automation solutions. The shift to AP automation software doesn’t just digitize the paper; it enables “straight-through processing,” where invoices are matched and approved without a human ever touching them. That is the gold standard of business spend management.

The $58 Expense Report: A Productivity Killer

Perhaps no financial process is as universally loathed as the expense report. It creates friction for employees and blind spots for finance.

Did you know that the average cost to process a single manual expense report for a one-night hotel stay is $58? That figure, from the Global Business Travel Association (GBTA), includes the time your employees spend taping receipts to paper and the time your finance team spends auditing them.

And that’s assuming they get it right the first time. The same study found that 19% of expense reports contain errors. Fixing those errors costs another $52 per report.

This is where travel and expense management often fails. When you rely on manual entry, you are paying over $100 just to reimburse a $150 dinner.

The solution is expense management automation.

Modern travel and expense management software captures data at the source. When an employee swipes a card, the data flows directly into the report. Automated expense reporting flags policy violations like that $200 bottle of wine the moment they happen, not three weeks later during an audit.

By adopting expense management software, you virtually eliminate that 19% error rate and give your employees hours of their lives back.

The Fraud Factor: You Can’t Catch What You Can’t See

Shadow spending isn’t just inefficient; it’s risky. The Association of Certified Fraud Examiners (ACFE) reports that asset misappropriation occurs in 89% of occupational fraud cases.

In manual systems, internal controls are just “suggestions.” A paper invoice can be paid without a PO. A duplicate receipt can be submitted twice. Spend management solutions enforce controls programmatically. If a purchase breaks the rules, the system blocks it.

The Verdict: Visibility is Control

The days of managing corporate finance with retroactive reporting are over. In an economic environment defined by uncertainty, you cannot afford to wait until the end of the month to see where your cash went.

Whether it is reigning in rogue software subscriptions with SaaS spend management, streamlining invoices with AP automation, or fixing the T&E drain with travel and expense management, the goal is the same: visibility.

Implementing a unified spend management platform turns the lights on. It transforms “Shadow Spend” into managed spend. It moves you from reactive “scorekeeping” to proactive strategic leadership.

Don’t let the shadows eat your budget. Invest in the right spend management solutions and take back control of your bottom line.

FAQs

Shadow spend refers to decentralized expenditure, like unvetted software subscriptions or out-of-policy travel that happens outside of formal approval channels. It thrives in organizations that lack a unified spend management platform. By implementing a comprehensive business spend management strategy, finance leaders gain visibility into these hidden costs. Modern spend management solutions centralize data from all sources (invoices, credit cards, and reimbursements), allowing you to control costs that were previously invisible.

Manual invoice processing is expensive, costing approximately $13.00 per invoice due to labor and error correction. Implementing accounts payable automation can lower this cost to around $2.81, generating savings of nearly 78%. By using ap automation software, organizations achieve "straight-through processing," where invoices are approved without human intervention. Top-tier accounts payable automation solutions also reduce processing cycle times by 82%, helping companies capture early-payment discounts and improve supplier relations.

With Shadow IT now accounting for 30-40% of IT spending, generic financial tools are no longer enough. SaaS spend management is essential for identifying "zombie subscriptions" - licenses that auto-renew for departed employees. Specialized spend management software and cloud spend management tools track software usage and contract renewals in real-time. This ensures that IT budgets are spent on active, approved technologies rather than wasted on redundant or unauthorized apps.

Ignoring automation is costly: processing a single manual expense report costs an average of $58 and often leads to a 19% error rate. Travel and expense management software eliminates manual data entry by capturing transaction details directly from corporate cards. By adopting expense management automation, companies can enforce policy limits instantly. This makes expense management software not just a convenience tool, but a critical financial control that saves thousands of hours in administrative work annually.

Manual audits are reactive and often miss patterns of asset misappropriation, which accounts for 89% of occupational fraud. Automated expense reporting uses AI to flag suspicious activities, such as duplicate receipts or split transactions, the moment they are submitted. When combined with accounts payable automation software, these spend management tools provide a proactive defense layer, enforcing internal controls programmatically and preventing fraud before the money leaves the company.