ExpenseAnywhere joins forces with FCM India to power next-gen T&E automation.

Gant Travel partners with ExpenseAnywhere to simplify enterprise T&E.

BCD Travel and ExpenseAnywhere unite to transform corporate T&E management.

ExpenseAnywhere wins exclusive AFI master agreement, a major nationwide mandate.

×

Contents

- 1 Automate the “Scorekeeping” Foundation

- 2 Build a Predictive Engine (The “Crystal Ball”)

- 3 Empower Strategic Storytellers (The Human Element)

- 4 Conclusion: The Only Way Out is Through

- 5 FAQs

- 6 Share:

- 7 Recent Post

- 8 Predictive Spend Analytics: Using Corporate Spend Management to Forecast Budgets, Not Just Track Them

- 9 The Rise of Zero-Touch Expense Reporting: How AI Is Eliminating Manual Entry in 2026

- 10 Petty Cash Is Dead: Why Property & Facility Managers Are Switching to Reloadable Prepaid Cards

The mandate for the modern CFO has changed. You are no longer just the guardian of the ledgers or the “Chief No Officer.” You are expected to be the Architect of Growth – the strategic co-pilot who guides the business through uncertainty.

But there is a massive disconnect between this expectation and reality.

While 82% of CFOs are pouring money into digital transformation, the day-to-day life of the average finance team remains stuck in the past. A stunning 49% of finance departments still operate with zero automation, relying on manual data entry and spreadsheets to survive.

You cannot be proactive when you are buried in reactive work. You cannot be a “seer” when you are busy being a “scorekeeper.”

To bridge this gap, you need to look beyond basic efficiency. Building a proactive finance team requires a three-part transformation: automating the foundation, building a predictive engine, and mastering the art of human influence.

Here are the three ways to build a proactive finance team in 2025.

Automate the “Scorekeeping” Foundation

You cannot build a skyscraper on a swamp. Before you can execute a high-level strategy, you must stabilize your core operations. Currently, many teams spend above 70% of their time chasing yesterday’s problems – tracking down missing receipts, correcting invoice errors, or manually reconciling bank statements.

The first step to proactivity is aggressive finance automation.

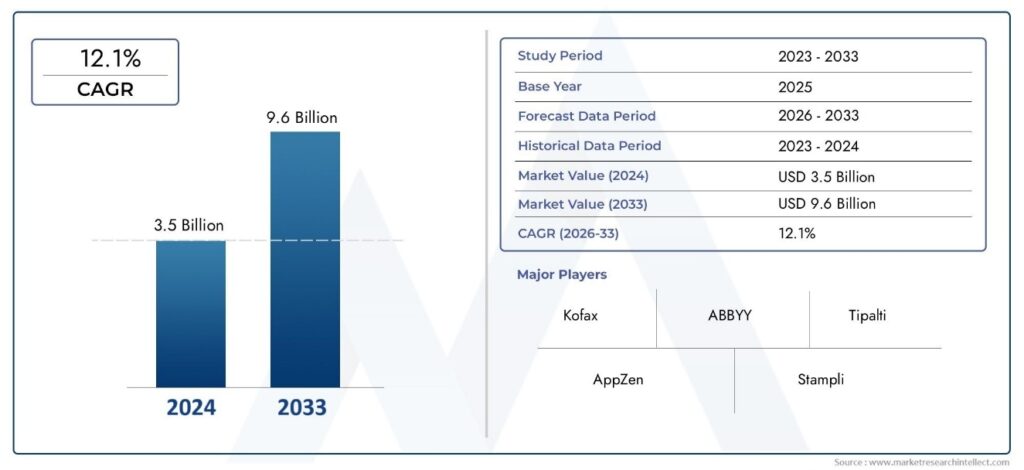

- Invoice Automation: This is about more than just scanning paper. True automation means achieving “straight-through processing,” where an invoice is received, matched, and approved without a human ever touching it. This moves your team from data entry to data analysis. The market for these tools is exploding, projected to reach nearly $9.6 billion by 2033, precisely because

- Expense Automation: Manual expense reporting is a morale killer and a compliance nightmare. Modern tools don’t just digitize receipts; they use AI to audit 100% of spend in real-time. Companies using AI-driven expense tracking save an average of $75 per report and, more importantly, free up finance talent to focus on high-value tasks.

The Proactive Shift: Instead of catching errors during a post-mortem audit months later, automated systems flag duplicate payments or policy violations before cash leaves the bank. That is the definition of proactive financial control.

Build a Predictive Engine (The “Crystal Ball”)

Once you have automated the manual drudgery, what do you do with the liberated time? You shift your gaze from the rearview mirror to the windshield.

Traditional forecasting is broken. In today’s volatile economy, static annual budgets are obsolete almost as soon as they are approved. It is no surprise that 92% of CFOs identify accurate forecasting as a significant challenge.

The solution is to build a “Predictive Engine” powered by AI and predictive analytics.

- From “What Happened” to “What If”: AI allows you to move to rolling forecasts and dynamic scenario planning. You can instantly model the financial impact of a 10% tariff increase, a supply chain disruption, or a change in pricing strategy.

- The Accuracy Advantage: The data is clear – 65% of finance teams using AI/ML rate their forecasts as “great or good,” compared to only 40% of those who don’t.

By 2028, Gartner predicts that 70% of finance functions will use AI for real-time decision-making. A proactive team doesn’t wait for the month-end close to see if they missed the target; they use predictive indicators to adjust course mid-month.

Empower Strategic Storytellers (The Human Element)

Technology is the engine, but people are the drivers. The most common failure point in finance transformation isn’t software – it’s the “skills gap.”

We are currently facing a dual crisis: a shortage of talent (with 300,000 accountants leaving the profession in three years) and a shortage of the right skills. The industry is dividing into two groups:

- The Processors: Those who focus on rules-based tasks. 92% of this group fear being “automated out of existence”.

- The Partners: Those who use data to drive business value. 84% of this group are optimistic about their future.

To build a proactive team, you must cultivate “Finance Business Partners” who are masters of data storytelling.

Data storytelling is the ability to translate complex spreadsheets into a compelling business narrative. It’s about finding the “Golden Thread” that connects the company’s strategy to its financial results.

- Reactive: Sending a P&L spreadsheet to a department head with a note saying, “You’re over budget.”

- Proactive: Sitting down with that department head and saying, “Our predictive model shows that if we continue this spending trend, we will miss our Q4 target. However, if we shift resources from Project A to Project B, we can get back on track. Here is the data to support that.”

Conclusion: The Only Way Out is Through

The gap between the “fully automated” 13% of finance teams and the rest of the pack is widening. The teams that are stuck in manual processes aren’t just inefficient; they are structurally incapable of being proactive. They are too busy bailing water to steer the ship.

To survive and thrive in 2025, CFOs must embrace this three-part mandate. You must deploy invoice automation and expense automation to secure your foundation. You must adopt AI to see around corners. And, perhaps most importantly, you must train your team to speak the language of business, not just the language of accounting.

The proactive finance team isn’t a luxury anymore—it’s the only way to stay relevant.

FAQs

A reactive finance team acts as a "scorekeeper," focusing 60-70% of its time on manual transaction processing, historical reporting, and auditing data after the fact. In contrast, a proactive finance team acts as a "seer" or strategic partner. It uses finance automation to handle the basics, allowing the team to focus on predictive analytics, real-time scenario planning, and influencing future business decisions rather than just reporting on past performance.

Invoice automation and travel and expense automation are the foundational requirements for a proactive team. Currently, 49% of finance departments still operate with zero automation, trapping them in manual data entry. Implementing these tools does more than cut costs; it allows for "straight-through processing" and predictive auditing, which can flag errors or duplicate payments before they occur, securing working capital and freeing up talent for high-value strategic work.

AI transforms forecasting from a static, annual exercise into a dynamic, real-time process. By using predictive analytics, finance teams can model complex scenarios – such as supply chain disruptions or inflation impacts – instantly. The data shows that 65% of teams using AI rate their forecasts as "great or good," compared to only 40% of non-users. Gartner predicts that by 2028, 70% of finance functions will rely on AI for real-time decision-making regarding cash flow and operational costs.

Data storytelling is the bridge between raw financial data and business strategy. It is the ability to weave a "golden thread" that connects what the business intended to do (The Plan), what actually happened (The Results), and what should happen next (The Forecast). As the "Finance Business Partner" role evolves, the ability to communicate these narratives clearly is essential for influencing C-suite decisions and moving beyond the role of a "trusted analyst" to a strategic advisor.

The finance industry is facing a dual crisis: a shortage of accountants (over 300,000 have left the profession recently ) and a skills gap. Finance automation solves the quantity problem by handling repetitive, rules-based tasks that burn out employees. Simultaneously, it helps solve the quality problem by redefining the role of the finance professional. By removing manual drudgery, organizations can attract and retain talent interested in high-value skills like data storytelling and strategic analysis, rather than data entry.

Share:

Recent Post

Know about the latest happenings in the fintech automation.

Click below to subscribe to our newsletter!

-

Near-Touchless

Operation - One-Click Fully Audited Reports

-

Seamless ERP & TMC

Integrations

-

Automated 2/3/4-Way PO

Matching - Effortless Vendor Onboarding

-

Globally-Accepted Smart

Prepaid Cards