Picture this: It’s 1985. You need to order office supplies. You fill out a purchase requisition form – in triplicate. Walk it to your manager’s desk for signature. Then to accounting. Then to procurement. Three weeks later, if you’re lucky, your staplers arrive. One form. Multiple approval desks. Weeks of waiting. Sound familiar?

Fast forward to 2026. You click a button on your phone. AI validates the purchase against policy, routes it to the right approver based on spend threshold, checks supplier compliance, negotiates the best available price, and places the order — all in 47 seconds. Your staplers arrive tomorrow.

That’s not science fiction. That’s electronic procurement software in action. And the journey from there to here? It’s one of the most dramatic transformations in modern business operations — one that most people outside procurement have never heard about.

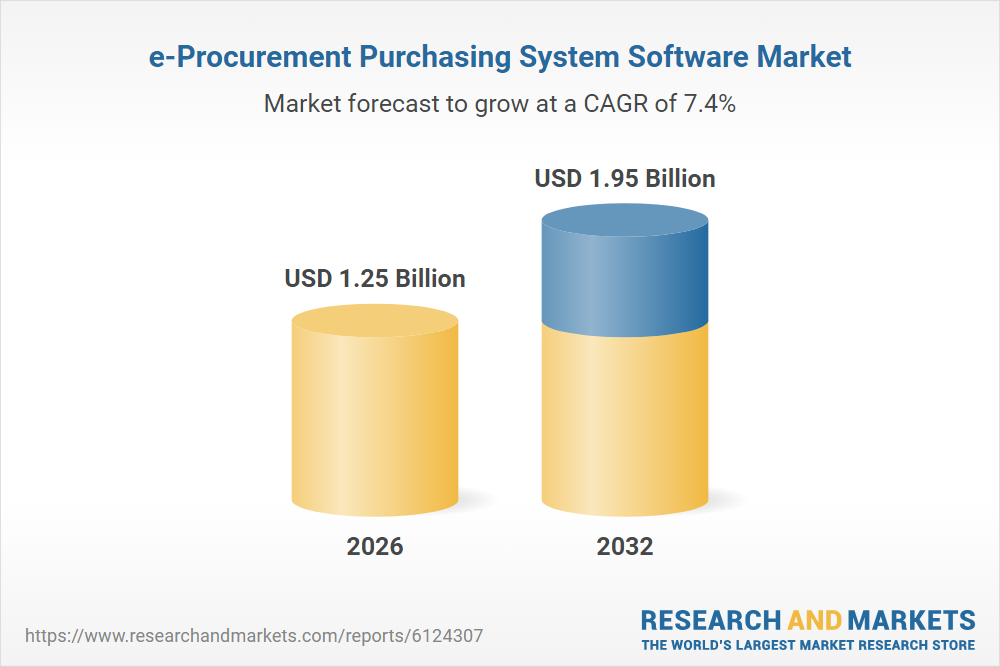

The latest research from ResearchAndMarkets reveals that the global e-procurement purchasing system software market is on a rocket trajectory, growing from $1.18 billion in 2025 to a projected $1.95 billion by 2032, with a compound annual growth rate of 7.37%. But those numbers barely scratch the surface of what’s really happening. This is the story of how purchasing went from the most manual, paper-intensive function in business to an AI-powered strategic nerve center that touches everything from compliance to competitive advantage.

Act I: The 1980s — When Computers Started Talking to Each Other

The EDI Era: Expensive, Exclusive, But Revolutionary

The procurement revolution didn’t start with a bang; it started with a beep. In the early 1980s, Electronic Data Interchange (EDI) emerged as the first digital procurement technology. For the first time, companies could transmit purchase orders, invoices, and shipping information from computer to computer without a single human touching a piece of paper.

But here’s what the history books don’t tell you: EDI was insanely expensive and complicated. Setting up a dedicated EDI connection cost between $25,000 and $40,000, the equivalent of over $70,000 today. It ran on leased telephone lines, required specialized IT expertise, and lacked any industry-wide standards. Every supplier relationship meant custom integration work.

The result? Only Fortune 500 companies could afford it. Small and medium businesses continued with their fax machines and carbon copies. But for those who could access it, EDI was transformative. Data moved at the speed of electrons instead of postal trucks. Order cycles compressed from weeks to days. Errors from manual data entry vanished.

EDI was procurement’s ‘moonshot moment’—proof that digital transformation was possible, even if most organizations couldn’t afford the rocket ship yet.

Act II: The Late 1990s — The Internet Democratizes Everything

When Amazon Taught Procurement What Was Possible

The internet explosion of the late 1990s changed everything. Suddenly, you didn’t need $40,000 and dedicated phone lines to digitize procurement. You needed a web browser and an internet connection. Companies like Ariba and Commerce One pioneered the first true e-procurement software platforms, creating electronic catalogs that vendors could maintain and buyers could access from anywhere.

The timing was perfect. Amazon had just launched in 1994, showing the world how easy online shopping could be. Executives started asking a dangerous question: ‘If I can buy books with one click at midnight from my couch, why does it take three weeks to order printer paper at work?’

Software companies raced to answer that question. The first generation of e-procurement systems emerged—functional for procurement professionals, but often clunky for everyone else. Still, the impact was undeniable.

Consider IBM’s Guadalajara plant. When Daniel Delfín designed their Replenishment Management System in 2000, the plant’s production value was $1.6 billion annually. Three years later? $3.6 billion. Electronic procurement software didn’t just make things faster—it made growth possible at a scale that manual processes simply couldn’t support.

The Catalog Catastrophe (And How It Got Solved)

But early e-procurement platforms hit a massive roadblock: catalog management. The theory was simple—vendors would create and maintain electronic catalogs of their products. The reality? Most vendors lacked the technical skills and infrastructure to do this. The burden fell on buyers’ IT departments.

Imagine maintaining electronic catalogs for hundreds or thousands of suppliers. Every product. Every price change. Every specification update. It was unsustainable. IT departments were drowning.

The solution came from an unexpected place: software providers evolved into hosting services. Instead of each buyer managing catalogs individually, platforms like Ariba started hosting catalogs on behalf of multiple vendors and buyers. It was the birth of the procurement marketplace—centralized catalog management that made e-procurement software actually scalable.

This might sound like a technical detail, but it was a watershed moment. It meant small businesses could finally participate. It meant procurement software could scale beyond a handful of strategic suppliers. It meant the dream of fully digital procurement was actually achievable.

Act III: The 2000s-2010s — The Giants Move In

When SAP and Oracle Went Shopping

As e-procurement matured into the 2000s, a second generation of platforms emerged with slicker interfaces and more sophisticated workflows. But a bigger story was unfolding: massive industry consolidation.

ERP giants like SAP and Oracle watched the e-procurement revolution with interest—and checkbooks. They started acquiring specialized procurement companies, bundling purchasing functionality into comprehensive enterprise suites. The pitch was compelling: ‘Why integrate five different systems when you can have one platform that handles everything from finance to procurement to supply chain?’

The market split into two philosophical camps that persist today:

Team Suite: Integrated platforms promise seamless data flow across your entire organization. One vendor. One contract. One throat to choke when things go wrong.

Team Best-of-Breed: Specialized solutions focus on doing one thing exceptionally well. Yes, integration is harder, but you get superior functionality where it matters most.

This wasn’t just a technology debate; it was a referendum on organizational philosophy. Risk-averse enterprises leaned toward suites. Innovative mid-market companies often chose best-of-breed. Both could be right, depending on context.

The Adoption Gap Nobody Wanted to Talk About

Here’s the uncomfortable truth from this era: despite incredible technological progress, adoption remained frustratingly slow in many industries. Academic research from the Architecture, Engineering, and Construction sector revealed that conservative organizational cultures, change management failures, and unclear ROI calculations were holding back the procurement transformation that software promised.

Companies would spend millions on e-procurement software, then struggle to get employees to actually use it. The platforms were powerful but not intuitive. They enforced compliance but created friction. They promised savings but required significant upfront investment and organizational change.

This is where procurement software learned a critical lesson: technology alone doesn’t drive transformation. User experience matters. Change management matters. Making the compliant path the easy path matters. Those lessons would reshape the next generation.

Act IV: The 2010s-Today — Cloud, Mobile, and the AI Explosion

When E-Procurement Software Finally Got Cool

The third generation of e-procurement software arrived with cloud computing, mobile accessibility, and a radical focus on user experience. Platform providers finally cracked the code: procurement software that felt as intuitive as consumer apps while maintaining enterprise-grade controls.

Cloud deployment meant no more six-month implementations. Mobile access meant approvals from anywhere. Modern interfaces meant employees actually wanted to use the system. But the real game-changer was what came next: artificial intelligence.

According to AI at Wharton’s research, weekly use of generative AI within procurement functions skyrocketed by 44 percentage points from 2023 to 2024. Today, 94% of procurement executives use AI at least weekly. Deloitte’s 2025 Global CPO Survey found that 80% of chief procurement officers plan to deploy generative AI over the next three years.

These aren’t pilot projects. These are production systems delivering real results:

- AI predicting demand based on historical patterns, weather data, and market trends

- Machine learning detecting anomalous purchasing behavior that signals fraud

- Natural language processing drafting contracts in minutes instead of weeks

- Computer vision analyzing supplier invoices and automatically matching them to purchase orders

- Predictive analytics forecasting commodity price movements to optimize sourcing timing

The broader procurement software market reflects this AI-driven transformation. According to industry research, the market is projected to grow from $8.03 billion in 2024 to $18.28 billion by 2032, more than doubling in eight years, fueled almost entirely by AI capabilities.

The Pandemic Accelerator

Then 2020 happened. COVID-19 forced a decade of digital transformation into a few months. Organizations that had been ‘planning to modernize procurement someday’ suddenly had no choice. Paper-based processes collapsed when offices closed. Manual approvals broke when people went remote. Supplier disruptions exposed the fragility of systems that couldn’t pivot quickly.

E-procurement software became a business continuity infrastructure. Companies that had invested in modern platforms kept operating. Those who hadn’t scrambled to implement in record time. The adoption gap that had persisted for decades essentially closed in 18 months.

But the pandemic did something else: it proved that procurement could be strategic. When supply chains seized up, procurement teams with good data and flexible systems became heroes. When costs spiked, AI-powered spend analytics identified savings opportunities. When supplier risk became existential, platforms with supplier monitoring capabilities provided early warning.

Procurement went from cost center to competitive advantage. And the software that enabled it went from ‘nice to have’ to ‘mission critical.’

Where We Stand Today: A $1.95 Billion Future

The ResearchAndMarkets analysis reveals a market at an inflection point. The e-procurement purchasing system software market reached $1.25 billion in 2026, growing from $1.18 billion the previous year. By 2032, it’s expected to hit $1.95 billion, a 7.37% compound annual growth rate.

But those numbers tell only part of the story. What they represent is a fundamental shift in how organizations think about procurement:

From: Process automation that makes buying faster

To: Strategic control planes that align compliance, supplier risk, and user experience at enterprise scale

From: Systems for procurement professionals

To: Platforms that serve procurement, finance, IT, legal, sustainability, and business units simultaneously

From: Reporting what happened

To: Predicting what will happen and recommending what to do about it

The Global Landscape

The research spans the Americas, Europe/Middle East/Africa, and Asia-Pacific, revealing distinct regional dynamics:

Europe leads in regulatory compliance features. GDPR, complex VAT rules, and aggressive ESG mandates drive demand for platforms with robust audit trails, data privacy controls, and sustainability reporting.

North America dominates in AI adoption. U.S. and Canadian organizations lead in deploying advanced analytics, predictive capabilities, and automation driven by labor costs and a culture of technological innovation.

Asia-Pacific grows fastest overall. Rapid economic development, digital transformation initiatives, and government support for technology adoption are accelerating e-procurement software uptake across the region.

The common thread? Organizations worldwide are realizing that modern procurement requires modern software. The competitive advantage goes to those who move fastest.

The Transformation Continues

From EDI in the 1980s to AI-powered platforms today, e-procurement software has undergone a complete metamorphosis. What started as a way to eliminate paper forms has become the foundation for how modern organizations control costs, manage supplier relationships, ensure compliance, and build competitive advantage.

But here’s the thing: this story isn’t over. Not even close.

In the second article, we will explore why e-procurement software has become absolutely mission-critical in 2026, how tariff volatility is forcing rapid platform adoption, what the market segmentation reveals about choosing the right solution, and how leading companies are using procurement software to transform their entire procure-to-pay process.

Because understanding where we’ve been is fascinating. But understanding where we’re going—and what it means for your organization—that’s essential.

FAQs

The journey began in the 1980s with Electronic Data Interchange (EDI), which allowed companies to move data digitally but cost up to $40,000 per connection. It evolved through the internet boom of the 1990s and the consolidation era of the 2000s, finally reaching today’s AI-driven third generation that prioritizes user experience and predictive intelligence.

The late 1990s democratized the industry by replacing expensive dedicated lines with web browsers and internet connections. Platforms like Ariba introduced electronic catalogs, moving the buying experience closer to the one-click convenience people enjoyed on consumer sites like Amazon.

Beyond simple automation, modern systems act as a strategic nerve center. Key benefits include compressing order cycles from weeks to seconds, eliminating manual data entry errors, and providing real-time spend analytics to identify savings opportunities.

By 2026, 94% of procurement executives use AI at least weekly to handle complex tasks. AI now allows platforms to predict demand based on market trends, detect fraudulent purchasing behavior, and even draft legal contracts using natural language processing.

"Team Suite" refers to integrated platforms (like SAP or Oracle) that handle finance and procurement in one system to ensure seamless data flow. "Best-of-Breed" refers to specialized software that focuses on superior purchasing functionality, often chosen by mid-market companies for its agility and specialized features.